The increasing preference for collateral-backed lending is propelling the global ABL market, reinforcing its value and relevance. The latest insights published by Market Research Future present a comprehensive view of the asset-based lending market—highlighting its current size, future growth potential, and strategic developments.

With dynamic financial models and risk-mitigation strategies, asset-based lending continues to gain momentum among mid-sized and large enterprises seeking liquidity solutions beyond traditional banking frameworks.

Get a sample PDF of the report at –https://www.marketresearchfuture.com/sample_request/23591

Market Dynamics

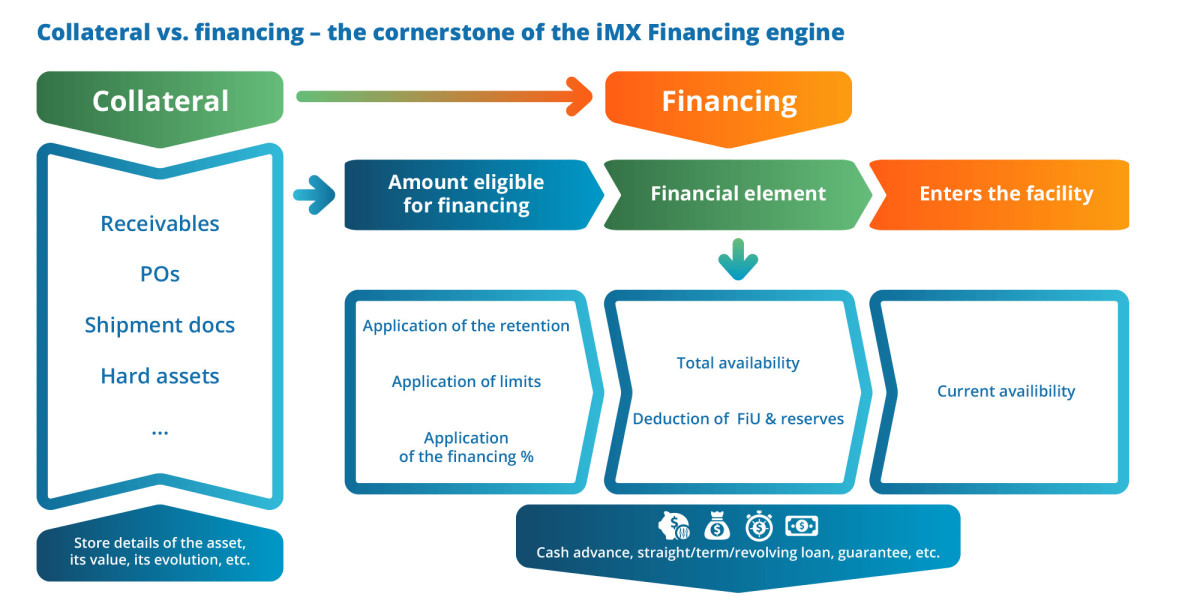

The asset-based lending market is experiencing a notable transformation, driven by evolving business needs, digital transformation, and growing acceptance of alternative finance. Unlike unsecured credit, ABL hinges on leveraging physical and financial assets—such as inventory, accounts receivable, and equipment—to secure funding.

Key trends and factors influencing market growth include:

Rising Demand for Working Capital: Businesses facing cash flow challenges or seeking rapid capital infusion are increasingly turning to asset-based solutions over equity financing or high-interest debt.

Adoption Among SMEs: Small and medium enterprises are recognizing ABL as a flexible and scalable financing alternative. It provides access to capital even with modest credit scores, provided adequate assets are available.

Technological Integration: Digital platforms and fintech innovation are streamlining risk assessment, underwriting, and asset evaluation. This enhances transparency and shortens funding cycles.

Globalization of Finance: Cross-border trade and supply chain complexities are also catalyzing ABL adoption, particularly in logistics, retail, and manufacturing sectors.

The expanding need for liquidity and the growing awareness about asset-backed strategies are expected to keep the momentum strong in the asset-based lending market.

Get Free Sample Report : https://www.marketresearchfuture.com/sample_request/23591

Competitive Landscape

The asset-based lending market is moderately consolidated, featuring a mix of established financial institutions, specialized lenders, and fintech disruptors. Major players are diversifying their portfolios to cater to varied industry verticals and geographies.

Key companies dominating the market include:

Wells Fargo & Company

Bank of America

JPMorgan Chase & Co.

Citigroup Inc.

HSBC Holdings plc

TD Bank Group

These financial giants are leveraging their scale and reputation to offer tailored ABL products to large enterprises. Meanwhile, alternative lenders and fintech firms are targeting underserved markets with flexible, tech-driven solutions.

Strategic partnerships, acquisitions, and platform enhancements are central to maintaining competitive advantage. For instance, digital onboarding processes and real-time asset monitoring tools are enabling lenders to serve clients with greater agility and reduced operational overhead.

Challenges and Opportunities

Despite its growing appeal, asset-based lending does face several hurdles. Among the most prominent challenges:

Asset Valuation Complexities: Accurately assessing the market value of diverse assets requires sophisticated models and frequent reappraisals, which can be resource-intensive.

Regulatory Compliance: Varying regulatory requirements across jurisdictions can complicate cross-border lending operations, especially for fintech entrants.

Borrower Education: Many potential borrowers, especially SMEs, lack a clear understanding of how ABL works or how to leverage it effectively, limiting adoption.

Yet, these challenges also unveil new opportunities:

Expansion in Emerging Markets: As developing economies continue to build robust SME sectors, demand for alternative financing—including ABL—is set to rise.

Integration with Blockchain: Smart contracts and blockchain-backed asset registries could revolutionize transparency and traceability in ABL transactions.

AI-Driven Risk Management: Predictive analytics and machine learning are being deployed to enhance risk profiling and fraud detection, improving lender confidence.

Browse a Full Report – https://www.marketresearchfuture.com/reports/asset-based-lending-market-23591

Furthermore, there's growing investor interest in ABL-backed securities, signaling that the market is not only expanding in volume but also maturing in sophistication.

The asset-based lending market is witnessing an upward trajectory, bolstered by digital transformation, flexible funding needs, and increasing global awareness. As businesses continue to seek reliable liquidity pathways, ABL is proving to be a resilient, scalable, and pragmatic solution across sectors. Whether it's a multinational optimizing its capital structure or a startup unlocking growth capital, asset-based lending offers a compelling value proposition for the modern enterprise.

For a full breakdown of the market’s dynamics, top players, and regional insights, visit the complete Asset-Based Lending Market Report.

Top Trending Reports:

accreditation-management-software-market

classroom-wearables-technology-market

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com